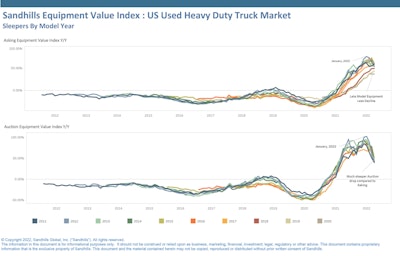

The Sandhills EVI indicates heavy-duty sleeper auction values increased 62.3% YOY, a 7-percentage point decrease from the start of the year when auction values were up 69% YOY. As shown in the graph, asking values for late-model sleeper trucks have displayed less decline than older models, likely due to the lack of new production available to replace the commercial trucks.

The Sandhills EVI indicates heavy-duty sleeper auction values increased 62.3% YOY, a 7-percentage point decrease from the start of the year when auction values were up 69% YOY. As shown in the graph, asking values for late-model sleeper trucks have displayed less decline than older models, likely due to the lack of new production available to replace the commercial trucks.

While seasonality predicted an 8% decline, ACT Research Vice President Steve Tam said lumpy new truck sales and the lack of used truck inventory are the more likely culprits in April’s slowing.

"Waning April new truck sales portend more weakness ahead in the secondary market, though March’s uptick has yet to make its way through the inventory maze,” Tam added, “The April deficit marks the tenth straight month of shrinking year-over-year sales, which have been hamstrung by the curtailed flow of units into used truck inventory. A peek ahead at near-term expectations suggests sales are usually below average in May, then return to normal in June and July before picking up in August.”

OEMs would love to boost new truck production and sales, which Tam said would presumably benefit the used truck market, "[but] the relief they seek on the supply-chain front has proven elusive," he said. Also, he added, inflation is taking a toll on consumer confidence and spending.