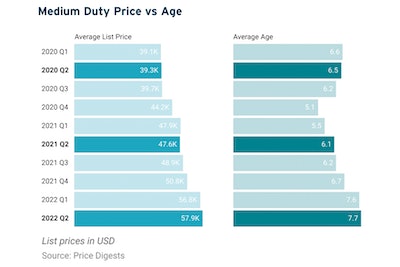

Average Prices

Prices for commercial trucks have been increasing steadily since 2020. We’re seeing the average list price $10k above where it was in Q2 2021 on medium duty trucks with the average age up from 6.1 to 7.7

The near stagnant difference between Q1 and Q2 indicates slowdowns in pricing, not only because Price Digests has already witnessed some of this in preliminary Q3 data, but the stagnation occurred in both Q1-Q3 2020 and Q1-Q3 2021. The real tell on whether the trucking market has slowed will come in the end of Q4 and into the start of 2023 where we’ve historically seen larger jumps.

As availability in trucks starts to increase around the new and used markets, it is anticipated that increased pricing will slow.

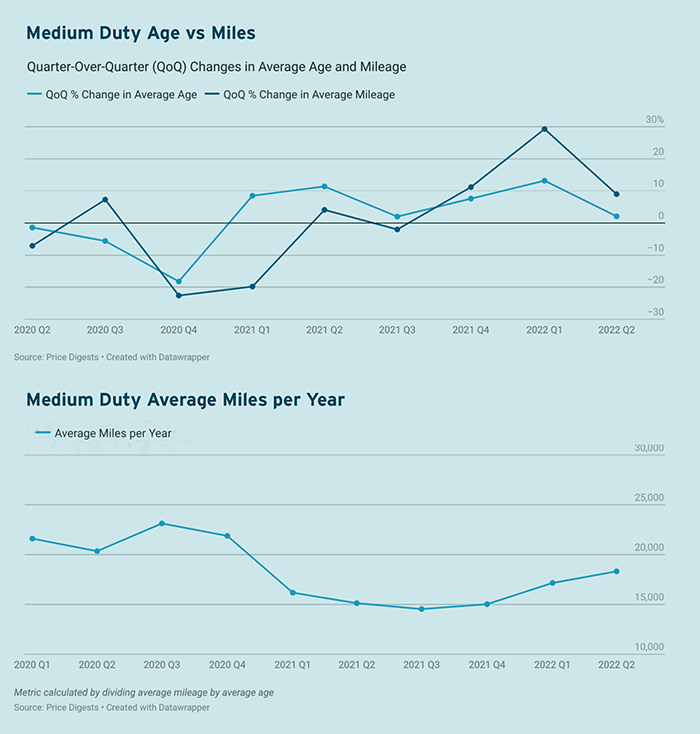

Average Age vs. Average Mileage

It is no surprise that the quarterly changes in mileage coincided with the age for most of the past two years. The interesting quarters are where they differed. Q3 2020 the average mileage was above Q2 while the average age dipped. The following quarter, Q4 2020, the drop in average mileage was even more extreme than the average age showing that while age steadily declined on the resale channel during this time, mileage took a while to show the same downward change, likely an indication of drop in inventory numbers, the lower mileage trucks were not purchased first in the period between Q3 and Q4 2020 which could have also been an influx of newer trucks as people sold off. Moving into the next quarter as 2021 started, the average age increased much faster than the mileage.

Midway through 2021, the age and mileage changes were more in sync between quarters. There was a much larger spike in average mileage during Q1 2022 and while this quarterly change leveled out by Q2 2022, it was still another increase. It is expected that the truck market will slow down with more inventory and hopefully lower mileage trucks available.

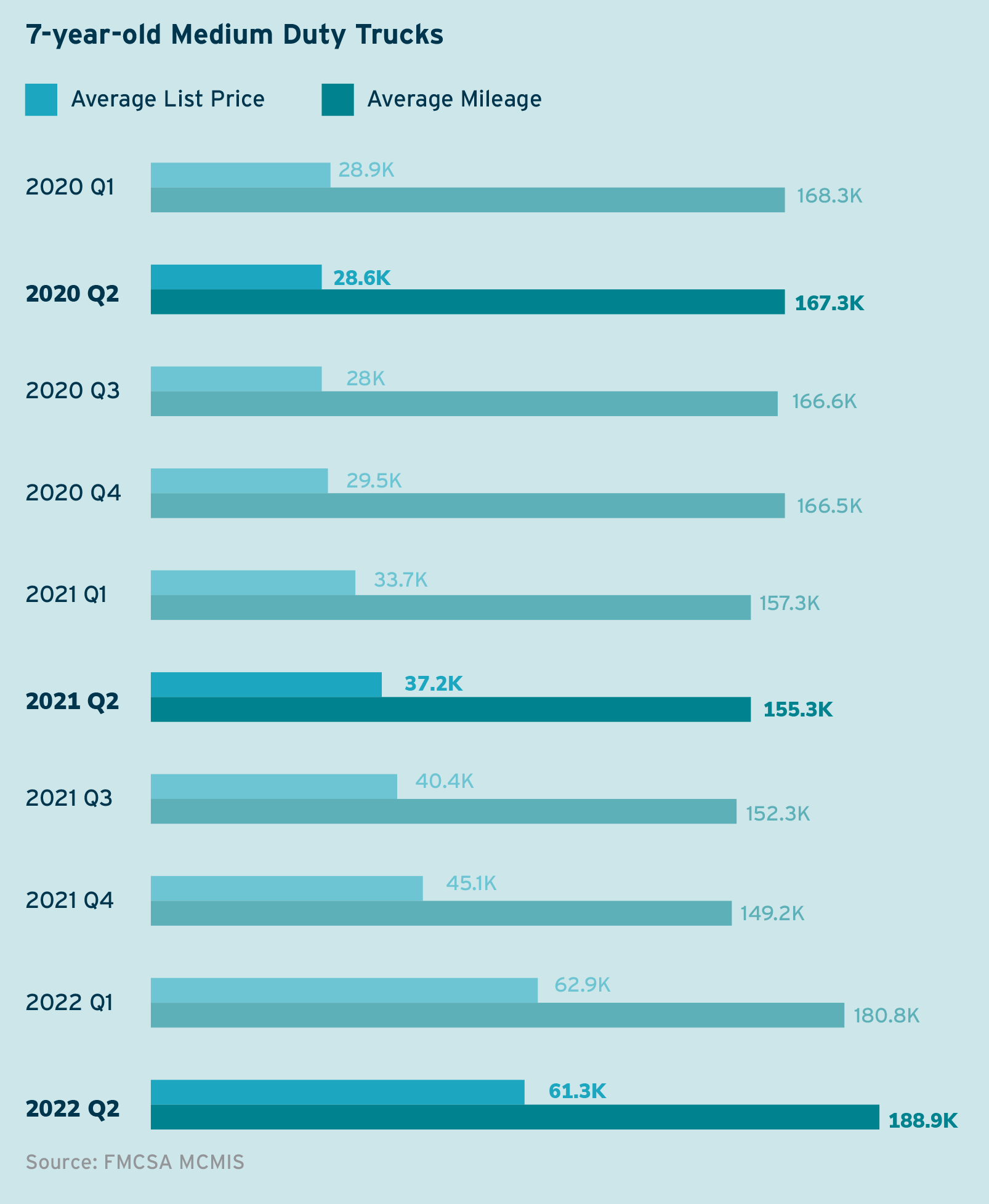

In Focus: 7-year-old Medium Duty Trucks

Narrowing the medium duty commercial truck data to 7-year-old trucks, the average list price increases in 2022 are more pronounced. Given the average age of medium duty trucks in Q2 2022, it is not surprising that they are the ones driving the overall pricing up. Not only were the average list prices the highest during Q1 and Q2 of 2022, but so was the average mileage.

As owners were holding onto trucks longer over the past two years (average age on medium duty trucks was on a steady incline from 5.1 in Q4 2020 to 7.7 in Q2 2022) they were adding this extra mileage while the demand did not subside as much as someone in the market for a truck may hope.

This is Part 3 of a five-part series on managing fuel costs as part of the Price Digests Market Report on shifting truck values. (Read Part 1, Part 2, Part 3, Part 4, Part 5 or download the entire guide.)